Conducting market mapping is much more than just gathering random numbers or listing potential clients. It's about... A structured process that combines research, analysis, and strategic interpretation to understand competitive dynamics, market size, existing opportunities, risks, and barriers to entry. This type of study allows a company to make decisions based on evidence, not assumptions. Many startups and small businesses, for example, often invest time and resources in segments that lack proven demand, while others miss good opportunities by failing to see adjacent or emerging markets.

Defining the objective and scope of the study.

The first step in market mapping is Clearly define the objective of the study, which may vary depending on the context: understanding the viability of a new product, identifying geographic regions with the greatest potential for expansion, analyzing consumer behavior, or evaluating who the main competitors are. It's very different, for example, to map the market for launching a B2B solution with a high average ticket price than for a B2C digital product with a high volume of consumers. Therefore, right from the start, It's important to define the scope: what exactly do you want to find out and why?.

Information gathering: geodata from primary and secondary sources.

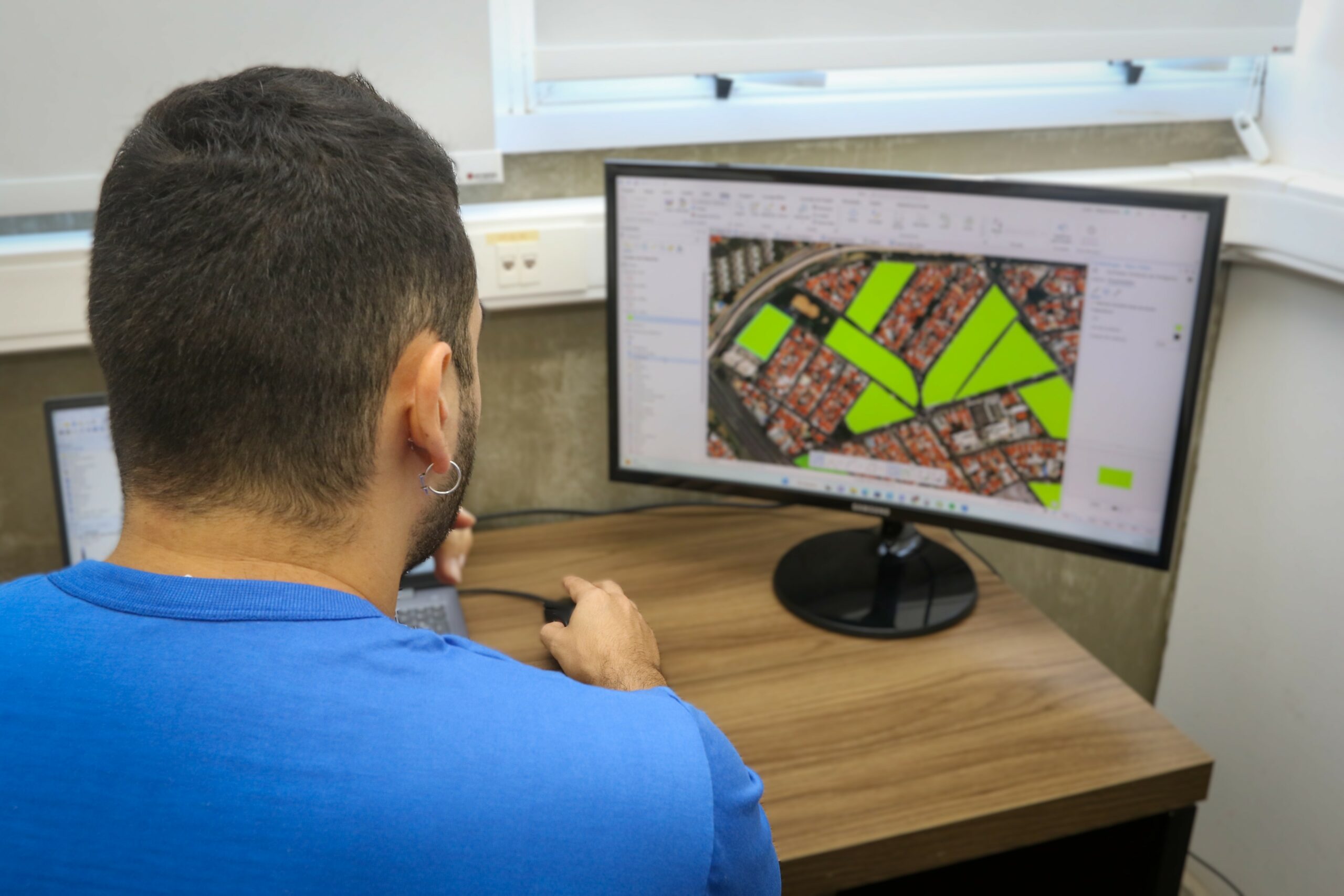

With the objective defined, the process begins. information gathering phaseHere, primary sources—such as interviews, forms, conversations with experts or potential buyers—are combined with secondary sources, such as industry reports, data from public institutions, and content from consulting firms. In B2B markets, for example, the geodatabases of Links They can provide highly relevant information about the size, location, maturity, and profile of companies. This way, you can learn about the specific characteristics of each territory with Linkages' analyses! Our solution provides analyses with up-to-date geodata on population, income, urban zoning, building guidelines, and other urban and environmental information.

Understanding demand, customer behavior, and competition.

The next step involves analyzing customer demand and behavior. More than knowing how many people or companies would buy the product, it's necessary to understand the factors that determine the purchase decision. In the agribusiness technology sector, for example, adoption depends heavily on risk perception, clarity regarding return on investment, and ease of integration with existing systems. In digital markets focused on the end consumer, such as education or wellness, convenience and the perception of immediate value tend to be more decisive. This stage typically... This involves building a persona or ideal customer profile (ICP) and, when possible, conducting fit tests through interviews or simple MVPs..

Structuring market sizing is also essential. Here, we work with the classic metrics TAM, SAM, and SOM: the TAM represents the total possible size of the market, the SAM This represents the truly accessible slice considering the target segment and geography, and the SOUND This represents the portion that the company can actually capture in the short and medium term. Imagine a telemedicine solution: TAM could be the global digital health market, SAM would be digital services in Brazil, and SOM would be private clinics interested in expanding remote care in the next 12 months. This clarity avoids unrealistic projections and assists in business planning. Remember, as our CEO says... Lucas Baldoni"The values must be expressed in $ currency, and the entrepreneur must always keep the geographical scope in mind!"

Next comes the study of the competition. Here It's not just about listing similar companies, but about evaluating their strategic positioning, differentiators, sales channels, pricing, and level of maturity. In some cases, the competitor is not necessarily the one selling the same product, but the one already solving the same problem in a different way. Legal software can compete not only with other software, but also with firms that offer operational consulting. This analysis avoids strategic myopia.

From analysis to action: transforming data into strategy.

Finally, Mapping translates into practical guidance through the identification of opportunities, barriers, and strategic recommendations.Companies that thoroughly undertake this process tend to enter the market faster, with better positioning and lower financial risk. This can mean... Identify a more specific initial territory, define traction channels with a higher probability of conversion, or even adapt the business model..

Location matters and is crucial to the success of any business! Linkages solves the lack of qualified data about the territory and optimizes market analysis with the application of geospatial AI. Our differentiator is delivering qualified and fast location recommendations and analysis. Want to know more? Contact us at [website address]. at*********@**********om.br Let's dive into your project!